Dialysis Cost Drivers and Quality ESRD Care.

Why Dialysis Is So Expensive

Every conversation about dialysis cost drivers starts with the sheer scale of the line-item. Medicare alone expects to pay US $6.6 billion to dialysis facilities in 2025 under the ESRD Prospective Payment System (PPS) at a base rate of $273.82 per treatment, and that rate is slated to rise to $281.06 in 2026. Centers for Medicare & Medicaid Services+1

Factor in hospitalizations, dialysis drugs, and lab tests and fee-for-service spending on ESRD patients tops $53 billion (2019 data, the most recent full accounting). MDinteractive Less than 1 % of Medicare beneficiaries consume more than 7 % of its budget, making dialysis an outsized burden even in a $4.8-trillion health-care economy. Understanding where those dollars land is the first step to reining them in and that is where the real dialysis cost drivers hide.

Fixed Infrastructure vs Variable Treatment Costs

Brick-and-mortar capital. A ten-station rural clinic might cost $5 million to build; a 30-station suburban center can crest $9 million when you add reverse-osmosis water systems, emergency power, and infection-control zoning. Washington State Department of Health(1) The depreciation schedule on that concrete and copper flows straight into the “facility” line of every PPS claim.

Machines & maintenance. A modern HD machine lists for $16-19 k and has a five- to seven-year life. Add annual service contracts, software updates, and periodic filter overhauls and the capital amortization alone can reach $8-10 per treatment and is a quiet yet stubborn dialysis cost driver that home-therapy startups often underestimate.

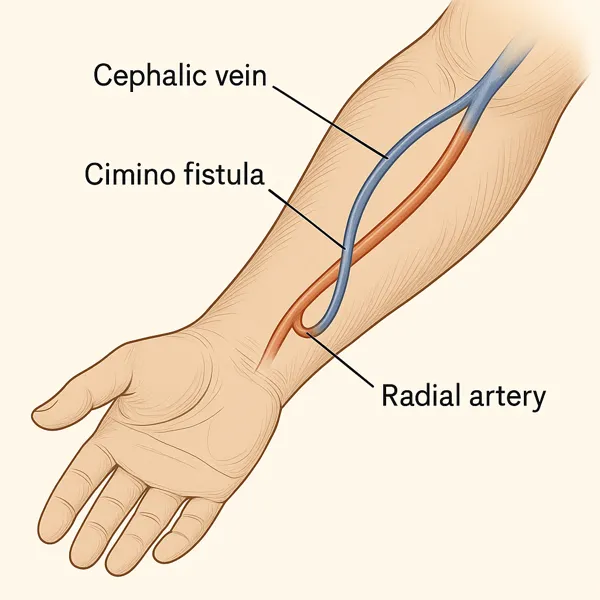

Consumables. Variable costs start when a patient shows up: dialyzers, blood-lines, bicarbonate cartridges, acid concentrate, heparin, single-use syringes, and fistula needles. Even with aggressive group purchasing, facilities spend $45-65 on disposables per in-center HD treatment; the margin on the PPS base rate lives or dies in that envelope.

Labor, Staffing, and Overtime Pressures

Labor now eclipses supplies as the fastest-rising of all dialysis cost drivers. Federal mandate requires an RN on site whenever patients are dialyzing; nationwide the average dialysis RN earns ~$86 k/year (≈$42 hour).ZipRecruiter Staffing ratios hover around one nurse for every ten to twelve chairs, but turnover sits north of 19 % per year, so operators pay shift differentials, agency premiums, and sign-on bonuses just to keep doors open.

Technicians, dietitians, and social workers round out the mandated interdisciplinary team. Wage inflation in these roles trails nursing but still outpaces PPS updates, forcing clinics to stretch schedules, consolidate chair shifts, or lean on overtime; all of which ripple directly into treatment cost. Each five-dollar bump in average hourly wage adds about $2.50 per treatment when modeled across a 24-station unit running two shifts a day.

Recruitment churn hits non-profits and for-profits alike, but smaller centers lack the scale to negotiate national staffing contracts, making labor a disproportionately large line item. In other words: until the workforce squeeze eases, payroll will remain the stealthiest of dialysis cost drivers.

Disposables, Dialysate, and Pharmaceuticals

Step into the re-processing room after a morning shift and you can almost smell the money burning. Each in-center treatment consumes a single-use dialyzer, arterial and venous blood-lines, two fistula needles, saline, a heparin syringe, and roughly 120 L of dialysate. Even with aggressive group-purchasing, clinics still lay out $45-$65 in consumables per chair per session and is the second-largest of all dialysis cost drivers after labor. Mira Health

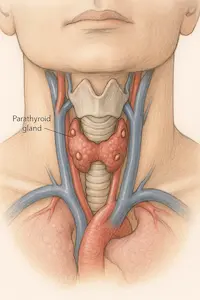

Then come the injectables. Erythropoiesis-stimulating agents (ESAs) once ate 25 % of the Medicare ESRD drug budget; biosimilars trimmed that to 18 %, yet the average still lands near $3 000 per patient-year.jmcp.org(1) Iron sucrose, calcimimetics, and IV vitamin D analogs tack on another $1 500-$2 000 annually. None of these costs flex with the PPS base rate; they ride on the pharmacy invoice, passed through to payers and patients alike.

Supply-chain hiccups magnify the sting. The 2024 bicarbonate shortage forced several chains to charter overnight trucking and ration concentrate, adding $1-$2 per treatment in fuel surcharges alone. In a 24-station unit running two shifts, that seemingly minor blip drains almost $35 000 off the yearly margin which is an invisible yet potent dialysis cost driver.

Hidden Overheads: Compliance, Water, and Waste

Behind the clinical floor lies a maze of dialysis cost drivers most outsiders never see:

- Regulatory compliance. CMS’s Version 9.1 ESRD Measures Manual stacks 32 quality metrics, and each one is audited. Facilities fund nurse-educators, data analysts, and downtime drills purely to stay survey-ready. Centers for Medicare & Medicaid Services

- Water treatment. A heat-disinfecting reverse-osmosis loop like the CWP-100 lists at $150 000-$200 000; annual membrane swaps and bacterial assays add $0.50-$0.75 per treatment. mcpur.com

- Hazardous waste. Dialyzers and blood-lines count as bio-hazard. Disposal fees range $2-$16 per kilogram worldwide; U.S. chains sit closer to the upper end, translating to $3-$5 per treatment. OUP Academic

Individually these line items look modest, but together they stack another $12-$15 onto every PPS claim—costs that escalate as standards tighten or landfill levies rise.

Modality Economics: In-Center HD vs Home HD vs PD vs Palliative Care

Dialysis cost drivers differ when modalities line up side-by-side:

| Modality (U.S. 2025) | Typical Annual Direct Cost | Key Cost Shifts vs In-Center HD |

|---|---|---|

| In-Center HD (three times weekly) | $88 000-$94 000 | Baseline—highest labor & infrastructure.ScienceDirect |

| Home HD (5-6 sessions/week) | $70 000-$85 000 | Machine amortized to patient; labor shifts to training & tele-RN hours.Mira Health |

| Peritoneal Dialysis (CAPD/CCPD) | $60 000-$75 000 | No water plant; consumables shipped to patient; hospitalization savings partly offset by supply freight.Mira Health(1) |

| Kidney Supportive / Conservative Care | $30 000-$40 000 (largely outpatient meds & monitoring) | Avoids machine, water, waste, and most drug spend—studies peg total annual costs at ≈40 % of dialysis pathways.BioMed Central |

Understandibly, the dialysis cost drivers you met earlier (labor, disposables, overhead) shrink substantially once care migrates home or toward palliative pathways. Home HD trades nurse wages for patient-training sessions; PD bypasses million-dollar water rooms; conservative management sidesteps the entire consumable stack.

Yet dollars aren’t the sole metric. Hospital-free days rise on PD; quality-of-life often improves with conservative care in the elderly. These nuances live in our full breakdown, Choosing the Right Dialysis Modality, which you can cross-reference for patient-centric factors beyond pure spend.

Provider Structures: LDOs vs Non-Profit Dialysis Centers

Large Dialysis Organizations (LDOs) operate about 90 % of U.S. facilities, leaving 10 % to hospital-based or independent non-profits like Dialysis Clinic Inc (DCI). MedPAC Scale gives LDOs obvious advantages: national supply contracts shave 6-8 % off disposables and central revenue-cycle teams push commercial claims out the door in days rather than weeks. Those efficiencies temper several dialysis cost drivers, but only when a center’s payer mix includes enough high-margin commercial plans.

Non-profits, in contrast, run leaner executive layers and reinvest surplus in patient education or home-therapy training. That trade-off shows up in outcomes: a 2023 multicenter analysis found adjusted mortality 2-fold higher for children dialyzed in for-profit facilities than in non-profits. PMC Adult studies echo the pattern for hospitalization rates and home-dialysis uptake. The lesson isn’t political; it’s structural. LDOs monetise scale, but the nonprofit model diverts earnings back into care processes—two different levers acting on the same dialysis cost drivers.

Payer Mix and Reimbursement Realities

Medicare sets the tone with the ESRD PPS—$273.82 per treatment in CY 2025. Centers for Medicare & Medicaid Services Yet MedPAC projects a 0 % aggregate Medicare margin for 2025, meaning facilities barely break even on federal business. MedPAC Survival therefore hinges on commercial plans that pay two-to-four times the PPS rate; facilities with ≥20 % commercial volume post better quality scores and stronger finances. kidneymedicinejournal.org The spread is the biggest hidden dialysis cost driver: it cross-subsidizes government shortfalls, funds wage inflation, and bankrolls facility upgrades.

Medicare Advantage (MA) is the wild card. Since open MA enrollment for ESRD in 2021, fee-for-service volumes dropped 10 % a year, tilting risk to private contracts negotiated behind closed doors. MedPAC Some LDOs report MA rates close to commercial levels; others call them “Medicare-plus-5 %.” Where MA pays low, clinics close or shift patients to home modalities to protect margin.

Patient-Level Cost Modifiers

Even a perfectly run clinic can’t outrun biology. Patients average ≈2 hospital admissions and 9 inpatient days per year, each stay adding $14 k–$18 k to total spend. dialysisdata.org Missed treatments spike those admissions by 17 %, while comorbidities like heart failure or uncontrolled diabetes add thousands in ESA, iron, and calcimimetic dosing. AJKD At the bench-level, these clinical realities eclipse many facility-side dialysis cost drivers, explaining why two centers with identical PPS revenue can diverge by > $10 000 per patient-year in total cost.

Future Trajectories & Cost-Control Levers

Value-based care models. CMS’s Kidney Care Choices and mandatory ETC models tilt payment toward home HD and PD, shifting labor and infrastructure costs out of brick-and-mortar units. Early data suggest every 10 % uptick in home adoption trims annual spend by $2 000–$4 000 per beneficiary.

Technological disruption. Compact waterless machines and wearable artificial kidneys promise to erase water-room overhead and slash consumables thereby attacking several dialysis cost drivers at once.

Xenografts & transplantation. Gene-edited pig kidney transplants could eliminate dialysis entirely for some patients; see our deep-dive Groundbreaking Pig Kidney Transplants for the economic case.

Digital monitoring. Tele-RN models and remote vitals cut unscheduled hospitalizations which are still the costliest variable in ESRD care, as an indirect dialysis cost driver.

Works Cited

- CMS. CY 2025 ESRD PPS Final Rule. 2024.Centers for Medicare & Medicaid Services

- MedPAC. Report to Congress: Medicare Payment Policy. Mar 2025.MedPAC

- Bhatnagar A, et al. Kidney Medicine. 2025;6:101179.kidneymedicinejournal.org

- Ku E, et al. JAMA Netw Open. 2023;6:e2331730.PMC

- MedPAC. Data Book: Health-Care Spending and the Medicare Program. Jul 2025.MedPAC

- Dialysis Facility Reports Guide FY 2024. USRDS.dialysisdata.org

- Lin E, et al. AJKD. 2020;76:846-856.AJKD